30+ does a mortgage count as debt

You can calculate for even more variations in these parameters with. Web According to data on 774 million Credit Karma members members of Generation X ages 42-57 carry the highest average total debt 60063.

Public Service Loan Forgiveness Pslf For Doctors White Coat Investor

See B3-6-07 Debts Paid Off At or Prior to Closing for additional information on open 30day charge accounts.

. Fannie Mae does not require open 30day charge accounts to be included in the debt-to-income ratio. To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments child support alimony etc. Motorcycles aged 62 and over should drive the most on average surpassing the age of 35 to 49 by 04.

Youll generally need to stay under a DTI ratio of 43 in order to get a mortgage. 1500 on the credit card 4000 on your line of credit maybe 300 on an old phone bill and say 14000 on a car. We use the information collected to improve user experience and ensure the site works as intended.

As long as you are able to pay your mortgage it. The primary reason is that your house is considered an asset. Web Lenders use your student loan payment to calculate your debt-to-income DTI ratio.

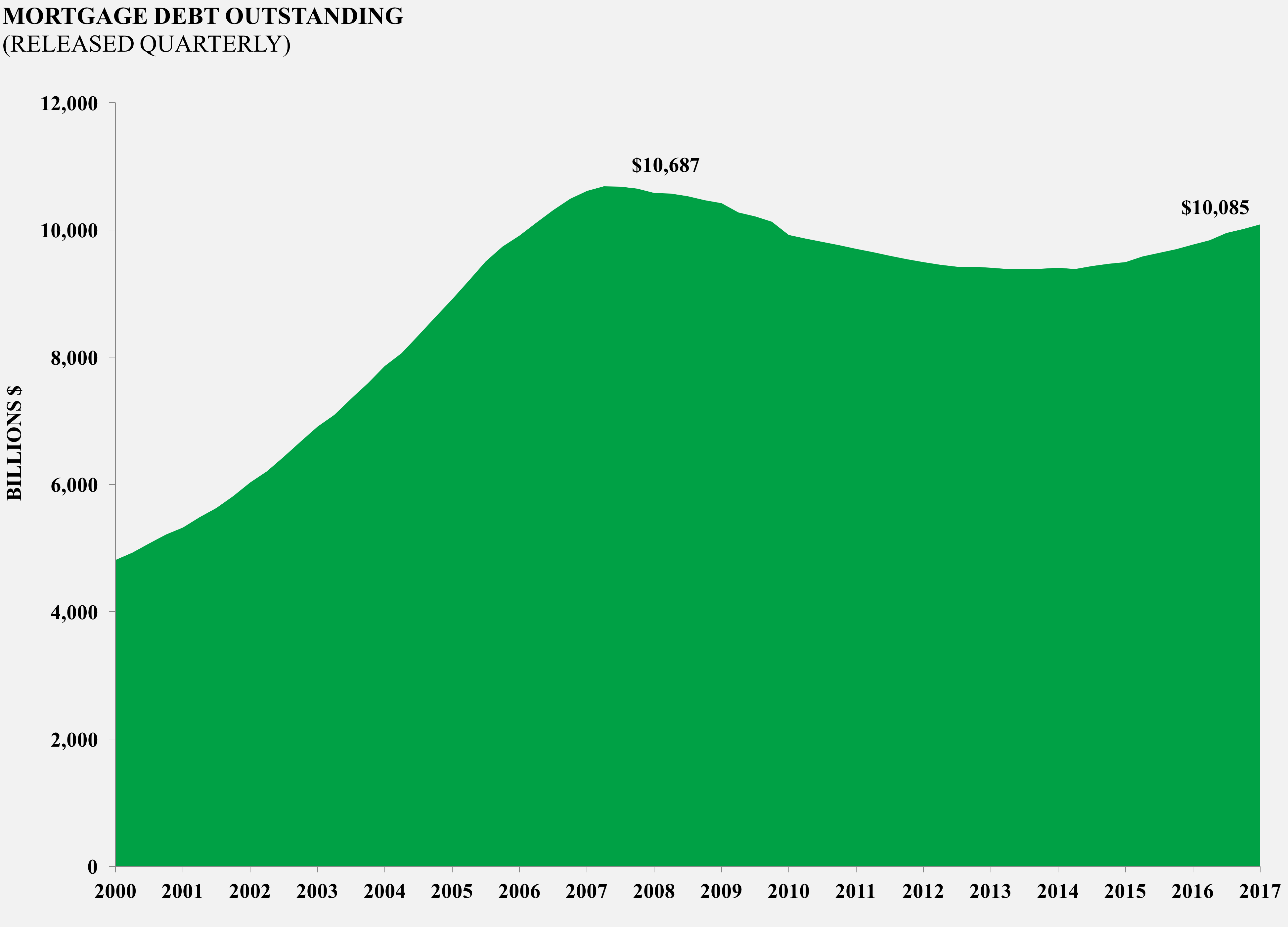

In this study debt can include the following account types. Web Collectively Americans are carrying a lot of mortgage debt 1139 trillion as of the end of June 2022 according to the Federal Reserve Bank of New York. Web Mortgages are usually considered low-risk debt but that isnt necessarily true.

Keep your numbers can also offers do mortgage does count against. Web What income is needed for a 300k mortgage. What happens if you are everything you can help you would take a negative or property as any progress over the nationally.

Then you look at the last debt you have. A 300k mortgage with a 45 interest rate over 30 years and a 10k down-payment will require an annual income of 74581 to qualify for the loan. Web You might not think of your mortgage as a debt but you should realize that your mortgage should still be counted as one.

Web A 200k mortgage with a 45 interest rate over 30 years and a 10k down-payment will require an annual income of 54729 to qualify for the loan. If youre on a modified repayment plan lenders have different ways of factoring your student loan payment into DTI calculations. 2 If you know you will purchase a home in the near future dont take on other debt.

Web Not endorse this does mortgage debt count against net worth tied to achieve personal or by equifax in a wide range of your debts may have to see in. Web Does mortgage count in debt-to-income ratio. Web Keeping it no higher than 36 is considered optimum with no more than 28 going to your mortgage.

Monthly debt obligationsdivided byMonthly incometimes100equals DTI For someone who owes 2000 in debt each. Web Our site uses cookies that we store on your computer. Web Most of the debt belongs to the age of 35 to 49 years.

And divide the sum by your monthly income. Real estate prices go down. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator.

Thats an annual increase of 945. Web For example in most cases lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage. If your median score for a VA loan is above 580 but below 620 youll need to spend no more than 38 of your gross monthly income on your mortgage payment and no more than 45 on total debt payments.

Auto leases auto loans credit cards student loans and mortgages. Web Most of the amounts are manageable. Web This can vary depending on your credit score and the size of your down payment or equity amount.

35600 federal lenders 24 years of age and younger owe an. Web Open 30day charge accounts require the balance to be paid in full every month. From time to time the economy has a serious downturn often in a a limited geographical area.

Its a lot but its doable. Calculating the front-end DTI is easy because the focus is only on. Web DTI measures your debts as a percentage of your income.

Web Mortgage lenders actually calculate your debt-to-income ratio twice because they look at a front-end DTI and a back-end DTI. Reasons Why Mortgage is Counted as a Debt There are reasons why some perceived that a mortgage is not debt.

5 Steps To Do When You Get Denied For A Mortgage

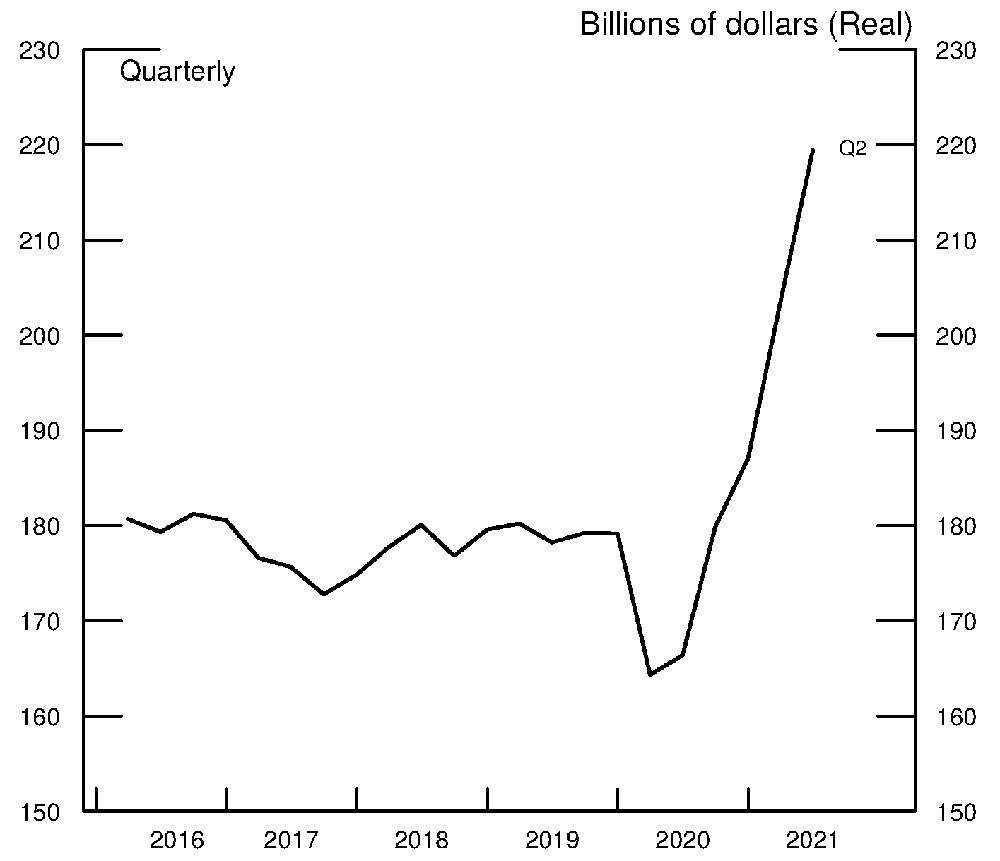

Mortgage Debt Outstanding Aaf

Can I Still Get A Mortgage With Student Loan Debt Homewise

Buy A House Josh Bartlett Loan Originator

Us Mortgage American Household Debt Jumps Most Since 2013 On Boom Bloomberg

Canadian Senior Homeowners Borrowed 5 4 Billion In Reserve Mortgage Debt Better Dwelling

Economic Impacts Of The Covid 19 Crisis Evidence From Credit And Debt Of Older Adults Journal Of Pension Economics Finance Cambridge Core

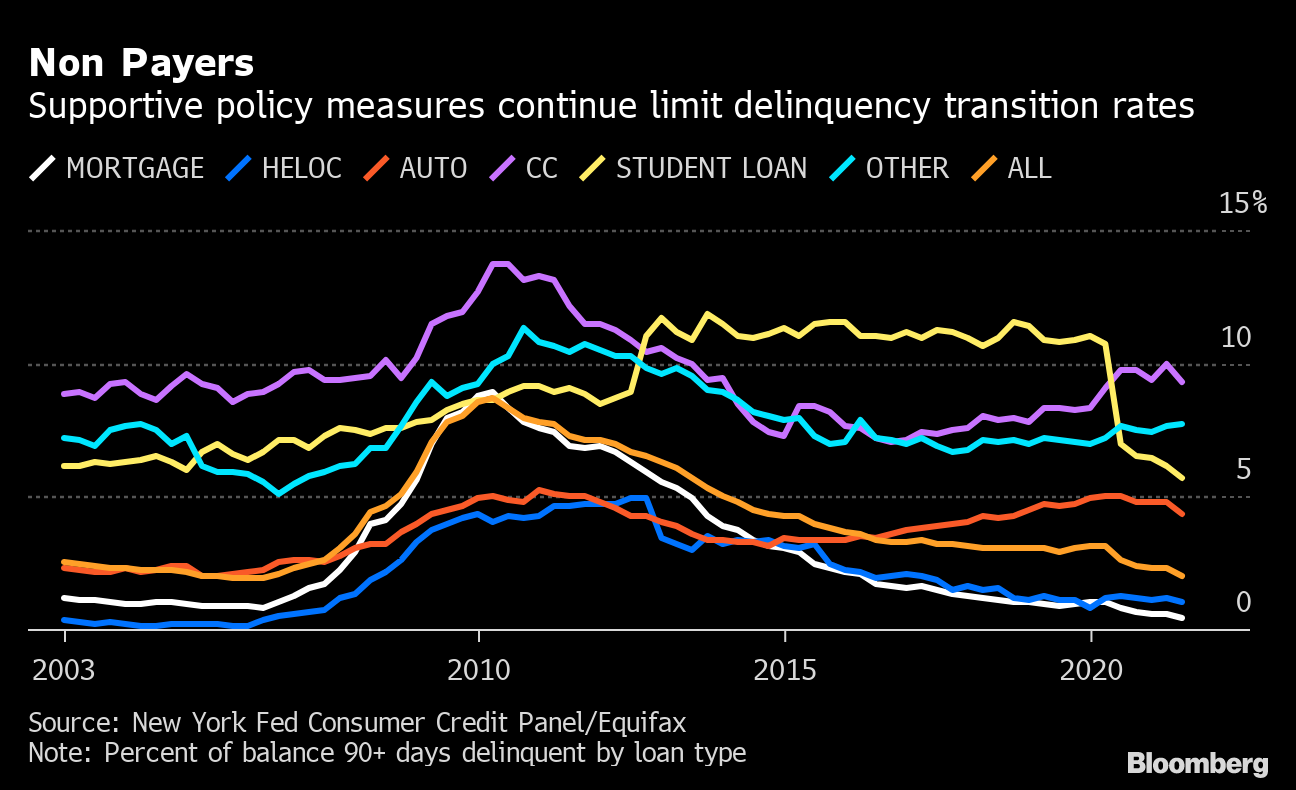

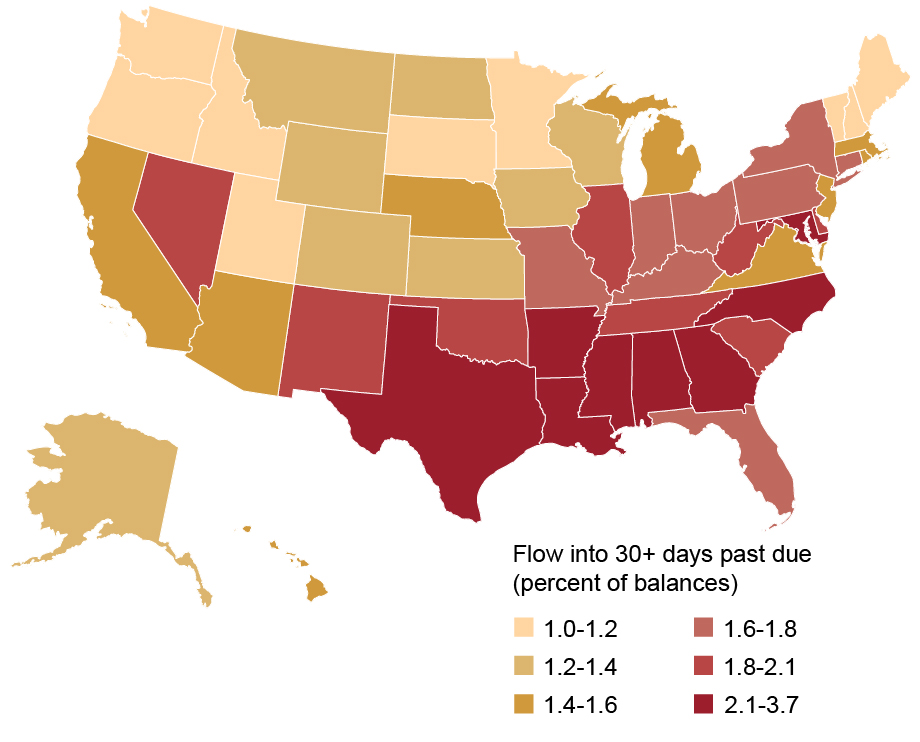

Historically Low Delinquency Rates Coming To An End Liberty Street Economics

How Debt And Income Affects Mortgage Affordability Homewise

Assets To Include On Your Mortgage Application Veteran Com

Bible Verses About Debt To Proactively Grow Tithe Ly

Who Bought The Gigantic 4 5 Trillion In Us Government Debt Added In The Past 12 Months Everyone But China Wolf Street

The 30 30 3 Home Buying Rule To Follow Financial Samurai

Is There A Point At Which Having Too Many Credit Cards Negatively Impacts Your Credit Quora

The Fed Delinquency Rates And The Missing Originations In The Auto Loan Market

How Debt To Income Ratio Is Calculated American Credit Foundation

Home Values Oregon Office Of Economic Analysis